Buying a house can be expensive, and it can take a long time to save up money for a down payment; however, it might be time for you to stop renting and buy your own place. What are some of the top reasons why it might be time to put down some roots?

Buying a house can be expensive, and it can take a long time to save up money for a down payment; however, it might be time for you to stop renting and buy your own place. What are some of the top reasons why it might be time to put down some roots?

Your Rent Is Going Up

The reality is that your rent will go up with time. Every time you renew your lease, it can be frustrating to see that rent check continue to increase. If you are tired of your rent going up, get a mortgage. You could lock in the same payment for 30 years.

You Are Going To Stay Put For A While

Are you planning on staying put for a while? If so, you don’t have to worry about buying a selling a house too quickly. Go ahead and purchase a house! You are going to be here for a while anyway, so you might as well get a stable mortgage.

You Don’t Want To Pay Someone Else’s Mortgage

Did you know that you might be paying someone else’s mortgage with your rent check? Why not use that money to pay off your own mortgage? After all, there’s no reason why you should feel obligated to use your money to pay down someone else’s home loan.

You Want To Build Wealth

If you want to build wealth for yourself and your family, one of the best ways to do so is to own property. Your property should go up in value over time, and 100 percent of the capital appreciation is yours because the value of your loan will remain the same, regardless of the capital appreciation of your house. If you want to build wealth, owning property is one of the best ways to do so.

Stop Renting And Buy Today

Clearly, there are plenty of reasons why you might want to stop renting and consider buying a house. You need to work with an expert who can help you find the right loan option to meet your needs. There are attractive opportunities out there, so if you are ready to build financial wealth, consider buying a house today.

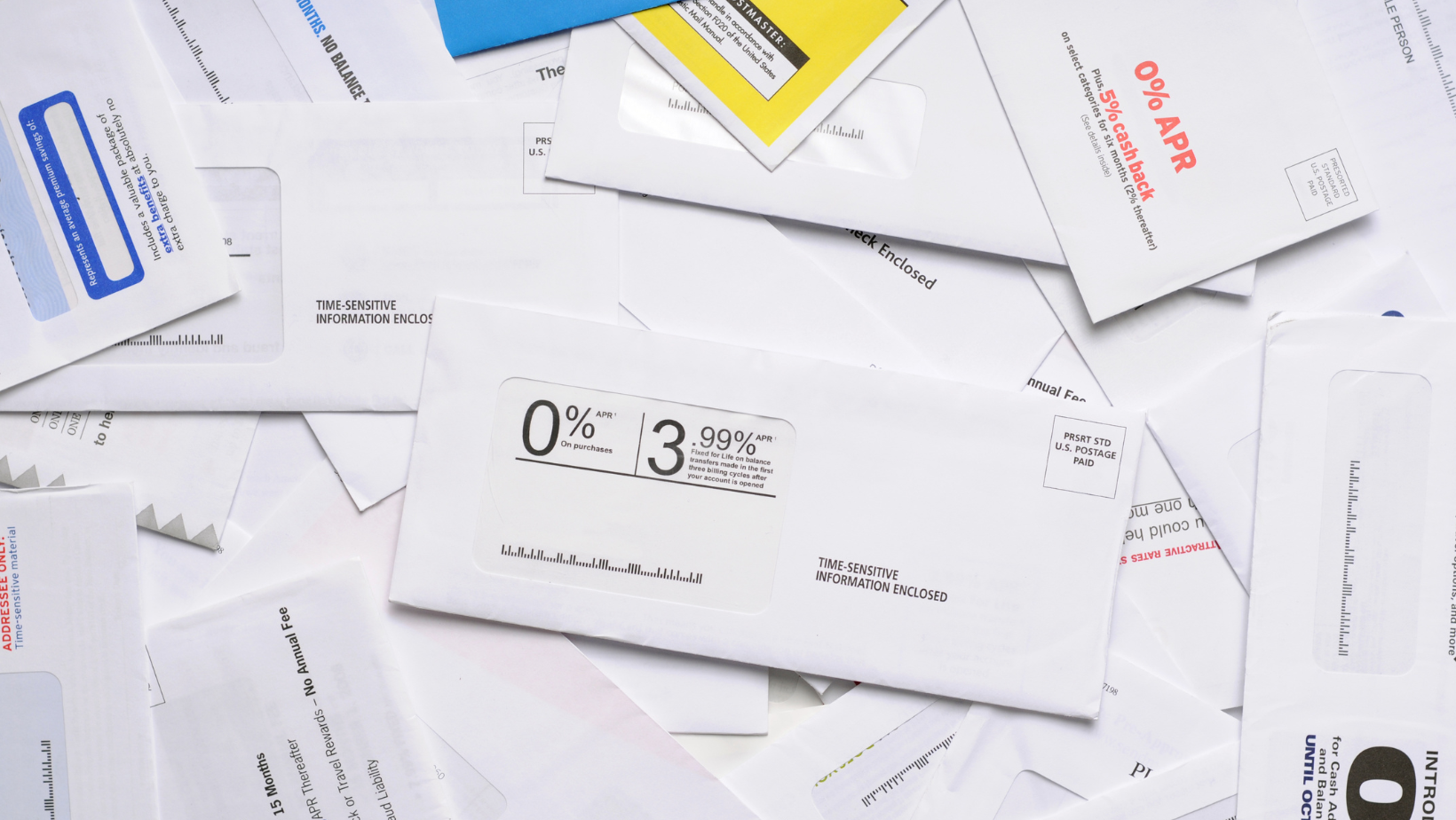

Congratulations! You have finally closed on your home loan, and you are excited to get moved in. Or, you may have just refinanced your home, and you are excited to enjoy it. Regardless, all of a sudden, you start to get a bunch of junk mail in your mailbox. It can be frustrating to sort through everything, and how did they get your information in the first place?

Congratulations! You have finally closed on your home loan, and you are excited to get moved in. Or, you may have just refinanced your home, and you are excited to enjoy it. Regardless, all of a sudden, you start to get a bunch of junk mail in your mailbox. It can be frustrating to sort through everything, and how did they get your information in the first place?