As we take time to honor Veterans Day, we extend our deepest respect and gratitude to the brave men and women who have served our country in uniform. Veterans Day is more than a day of remembrance; it is a chance to reflect on the sacrifices made by those who have protected the freedoms we cherish and to recognize the resilience, dedication, and strength they embody.

As we take time to honor Veterans Day, we extend our deepest respect and gratitude to the brave men and women who have served our country in uniform. Veterans Day is more than a day of remembrance; it is a chance to reflect on the sacrifices made by those who have protected the freedoms we cherish and to recognize the resilience, dedication, and strength they embody.

For us in the mortgage industry, this day holds special meaning. Many veterans and their families have sacrificed so much to ensure the security of others. It is our privilege and duty to provide support that makes a difference in their lives—whether through tailored loan options like VA loans, guidance on homeownership, or simply listening and understanding their unique needs.

On this Veterans Day, we reaffirm our commitment to serving those who have served us. We encourage everyone to join us in expressing appreciation for our nation’s veterans—not just today but every day. Let us stand together in gratitude and continue to support their journey to achieving the American dream of homeownership.

Thank you, veterans, for your service, courage, and the legacy you continue to inspire.

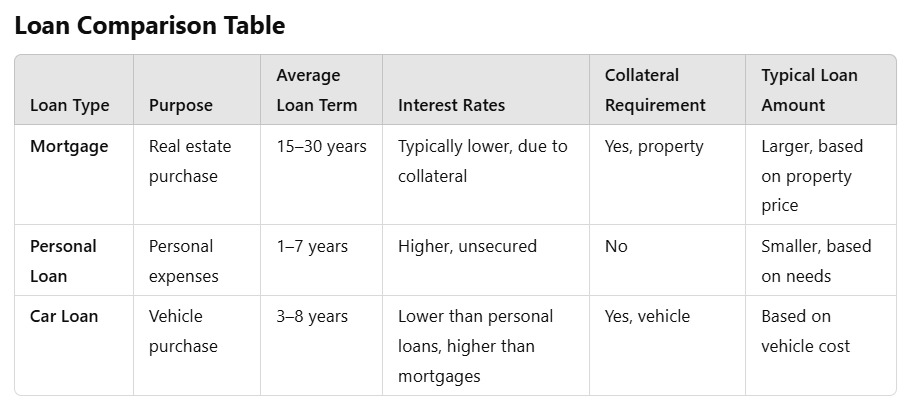

Planning to buy a home, finance a car, or cover unexpected expenses? Many loan options exist to help you achieve your financial goals, but choosing the right one can be challenging. Here’s a breakdown of the most popular types of loans, their unique characteristics, and what you need to know to make the best choice for your financial future.

Planning to buy a home, finance a car, or cover unexpected expenses? Many loan options exist to help you achieve your financial goals, but choosing the right one can be challenging. Here’s a breakdown of the most popular types of loans, their unique characteristics, and what you need to know to make the best choice for your financial future.